A volatile week with new highs and a big selloff leaves me taking some profits and cherry picking a few pullback situations. The market is getting nervous about growth prospects - or is it?. Maybe the old metrics are outdated. Not heard any one say "sell in May" though.

Portfolio News

In a week where S&P 500 rose 0.42% with a few all time highs in the week, my pension portfolio dropped 1.06% driven by Europe weakness (especially banks and utilities), agriculture and solar power.

Markets have been marching along smartly to the reopening beat. Then they got the wobbles with Treasury yields falling as much as 15 basis points. The selloff was a conditioned reaction - falling yields equals slowing growth. My gut is telling me the pandemic has put such a distortion into the data that we cannot safely rely on old rules of thumb.

Big movers of the week were Gemfields Group (GEM.L) (+39%), JinkoSolar (JKS) (+12%), Global X Lithium (LIT) (+8%). Gemfields which mines rubies and emeralds in Mozambique and Tanzania were at a loss to explain a one day jump in price. The business is operating and there are auctions happening to sell product.

Crypto booms

Bitcoin price finished the week pretty well where it started. The peak to trough move of 8.6% was much smaller than we have seen recently

Biggest swing in my portfolios was STEEM at 30% from peak to trough finishing the week 14% higher.

Too bad HIVE did not follow suit as it dropped 3% on the week.

Bought

Tidewater Inc (TDW-WT): Oil Drilling. In TIB546, I did the chart comparisons last week for the Tidewater Warrants compared to the stock. I did the contrarian thing and added the laggard warrants to one portfolio that did not have any holdings. These are November 2024 expiry 100 strike call warrants and give me exposure to 2000 shares of Tidewater for $0.35 per warrant. Here is the most recent price comparison chart - Tidewater is the bars and the yellow line are the warrants I bought.

Long standing partial order was filled on a down day (July 8) in my other portfolio at a whole lot less ($0.277).

Eni Spa (E): Europe Oil. With rising oil prices and OPEC+ struggling to agree to increase output, I averaged down a long standing holding in Eni. Dividend yield 3.48%. Did sell August expiry covered call at exactly 1% to strike premium. Coverage was not as high as I would like but it is time to find the exits and make some covered call income along the way.

Options chains shows my trade was the only trade of the day.

iShares MSCI Spain Capped ETF (EWP): Spain Index. Averaged down entry price in one portfolio following add I made last week in another.

Loop Industries, Inc (LOOP): Specialty Chemicals. Averaged down entry price in one portfolio following the add I made last week in another.

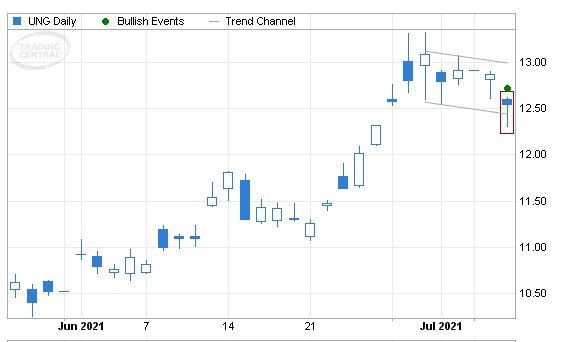

United States Natural Gas Fund, LP (UNG) : Natural Gas. I received a buy signal from ETF Trade ideas - bought a small parcel.

These signals look like trade ideas rather than investing ideas. I am exploring them a little to see if they work as investing ideas.

I will watch closely. What the trade ideas do not include is when to exit. One way is to set Fibonacci extension as a level ($13.60 is the 1.27 level). The other way is to go back in time to see how much price jumps through the summer months but only after the shale boom released so much natural gas from 2017/8 onwards.

Looking back over the last two summers there are similar size price spikes (I cloned the middle one). A repeat of that takes this trade to $15. I am going to put two targets on - one at $13.60 for half and one at $15.00 for the other half

Commerzbank AG (CBK.DE): German Bank. July 7 was a bit of a rout in European markets - I used Friday bounce to replace stock in one portfolio assigned in May expiry at 2.2% discount to assigned price. Sold an August covered call at 2.2% premium with 5.7% coverage. The rout is still priced in with high implied volatility.

American Eagle Outfitters, Inc (AEO): US Consumer. Jim Cramer idea to add on weakness. Used the proceeds of sale of another consumer name (see below) to add to my small holdings. This averages down entry price a little. Dividend yield 2.06%. I sold another covered call for July expiry at same strike as the previous ones. Premium was modest but coverage is more than 10% for a week.

Honeywell International Inc (HON): US Industrials. Jim Cramer idea to add to holdings based on high exposure to recovering airline industry backed by a solid management team. Added a half position at a price higher than last entry in October 2020. Dividend yield 1.68%

Sold

Amazon.com Inc (AMZN): Internet Retail. Long standing pending order at 52 week high was hit to close out half my small holding for a 124% blended profit since October/November 2018. I had added to the holding in February 2021 - blending that profit would have been at 55%. I am going to book the lower profit.

The Estée Lauder Companies Inc (EL): US Consumer. Jim Cramer idea to reduce holdings. I decided to close out fully and use proceeds for two of his other adds. Locks in 7.5% profit since May 2021.

Shorts

No change.

Cryptocurrency

No trades. I did promise last week to write up the Fastest Rising portfolio.

Background: I do not have enough time to research altcoins for potential. I use market capitalisation as a proxy for market knowledge. For the most part I invest in a portfolio of 10 coins from the Top 20. An idea I tested in January 2018 was a portfolio of 10 fastest rising coins. I used CoinMarketCap.com data to see which coins had risen the most in the Top 200 over a 2 month period and picked 10 that I could buy on Gate.io. I basically did not look at that portfolio until April 2021. Only one coin went up - LEND which converted to AAVE in October 2020. That coin went up 387% till now. I could not have picked that as the winner then - had no basis for it.

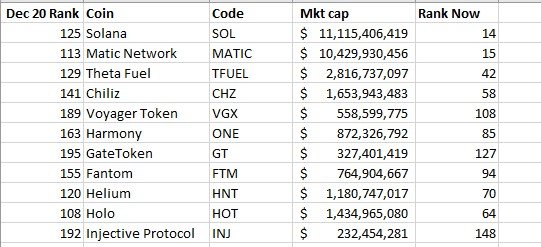

This time I decided to widen the time period and have taken a 6 month gap and listed the fastest risers. They are in the table below and are sorted from most places up to the least. There are 11 in the list as Voyager Token is not available for trade on any of my 4 trading platforms.

I am currently holding Solana (SOL) as it is in the top 20 and Gate Token (GT) as it is the token used to pay fees on Gate.io. My plan is to construct another Rising 10 portfolio using this list. Now there is some risk in choosing a portfolio this way - a coin may just run out of steam. DOGE is a classic example - it ranked 12th fastest riser. I think it has run what it will run.

Another way to choose a portfolio is to choose the coins that have risen in positions but based on their ranking in the current list - say Best Placed Risers. That list looks quite different - note: I have excluded stablecoins (e.g., USDT, BUSD)

Income Trades

Start of the process for August expiry income trades (3 out of 5) in a quiet week with 4 covered calls (US 3 Europe 1) and only one naked put (US 1).

JinkoSolar Holding Co., Ltd (JKS): Solar Power. With opening price of $58.79 which is 16% up on the week, I added to naked puts sold by selling a July 55 strike put option. This is the same level as the last stock tranche I bought. Premium was a high 2.7% of strike - not bad for a week's exposure. There is some risk riding here that I could get be forced to buy the stock - this tranche is smaller than the stock that will get assigned away on lower strike covered calls. Not happy to see the Friday's move was 3.45% down to close at $56.76

This news item was not what drove the drop - it is vaguely positive news streamlining the way JKS supply chains work.

Currency Trades

This was week two of looking a little more closely at forex trades. I am using two sets of trade signals. Some are trend trading and some are swing trading. Success rate (40%) was lower than I hoped - I am getting close to canning this form of trading - one needs to be at 60% win rate if any of the winning trades close at less than 1:1.

Week's trades: EURJPY short (win); EURGBP long (lose); GBPUSD short (lose); AUDNZD short (lose); AUDUSD short (win)

Here is a sample swing trade - i.e., not a trend trade.

British Pound (GBPUSD): Short trade - signals from TradeJuice and Smart Charts. Uptrend broken and divergence on MACD - stopped out. This is the challenge of swing trading.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin http://mymark.mx/Galaxy

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

July 5-9, 2021

Posted Using LeoFinance Beta