Markets buckled to the inflation fear and then along came the first bank failure. This was the week to be staying out of markets or just nibbling away looking for good entry prices on quality stocks and working on the hedging

Portfolio News

In a week where S&P 500 dropped 4.52% and Europe dropped 3.65%, my pension portfolio dropped 3.75% = not as bad as US markets. Big drag from Australian resource stocks, Credit Suisse (CSGN.SW), and widespread selling across all US sectors (shipping, Internet services, regional banking, restaurants, small caps, healthcare, alternate energy, fertilizer, automotive, etc)

Big movers of the week were AXP Energy (AXP.AX) (+50%), Plexus Holdings (POS.L) (+31.6%), Direxion Daily Real Estate Bear 3X Shares (DRV) (+21.9%), Stuhini Exploration (STU.V) (+20%), Westgold Resources (WGX.AX) (+15.1%), Appen Limited (APX.AX) (+14.2%), Bod Science (BOD.AX) (+13.3%), NeuRizer (NRZ.AX) (+12.7%), ProShares UltraPro Short QQQ (SQQQ) (+11.8%), Redbubble (RBL.AX) (+10.2%)

No themes in this week's movers with 2 shorts on the list and penny stock jumps with the rest maybe news driven. Plexus announced a major contract win (Mar 6). Neurizer completed a share placement and appointed a corporate advisor. Westgold announced major output increase - clearly leaked as announcement came out Mar 13. Bod Science added a new technology to improve bio-availability of its cannabis products.

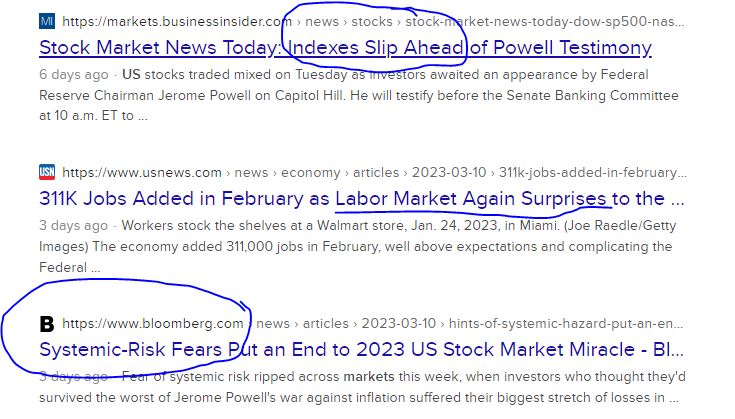

Markets were edgy ahead of Jerome Powell appearance on Capitol Hill and were shaken when he said there could be several more rate rises. Add in the collapse of Silicon Valley Bank and the systemic-risk fear took over despite a strong jobs report.

Inflation headlines were leaning to the bad outcomes no matter what Powell said.

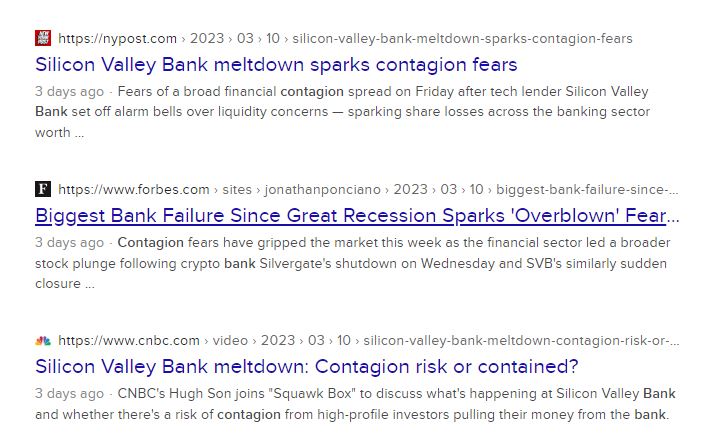

The collpase of Silicon Valley Bank was the piece of systemic risk the market could not cope with.

Crypto Wobbles

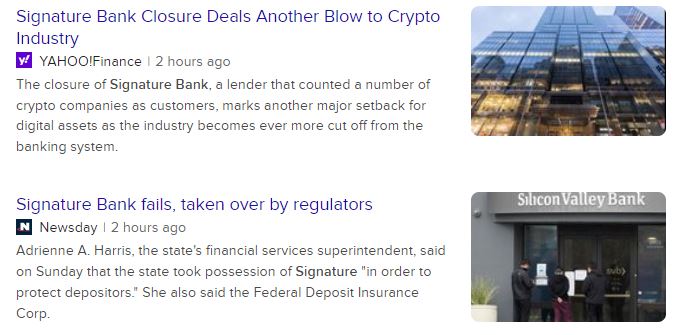

Last week was Wells notices week. This week is bank collapse week with Silicon Valley Bank failing and Silvergate Bank winding down its operations.

And on Sunday New York state regulators began taking over Signature Bank (Mar 12). My read is there is a lot more to this than meets the eye as what it does is lock out access to financial markets for many crypto businesses. The Gary Gensler-Janet Yellen combination is at work to close down the crypto industry - they are well known antagonists.

https://www.yahoo.com/entertainment/signature-bank-stock-sinks-10-193131113.html

Bitcoin price dropped 9% when Silicon Valley Bank failed with a peak to trough range of 13%. Surprisingly price rallied in weekend trading to finish the week a little higher than the start

Ethereum chart looks much the same with a 12% drop from the open but finishing the week 3% higher.

My largest crypto holding (HIVE) was not able to find buyers like that with a 24% peak to trough range ending 7% down.

Talk is that Ripple (XRP) could be a big loser as the Gensler/Yellen show rolls through town. Nicely surprised to see price holding not too far below my entry last week (shy of 2% down).

Bought

Marvell Technology Group (MRVL): US Semiconductors. AAPlus idea. Wrote April expiry covered call for 2.34% premium with 13.5% price coverage. Makes up for lousy dividend yield of 0.53%

Vulcan Materials Company (VMC): US Building Materials. AAPlus added to their holding. Added another small parcel on the way to get 100 shares for writing covered calls. Dividend yield 0.99%

Verizon Communications (VZ): US Telecom. AAPlus added to their holding. Averaged down entry price in one portfolio. Dividend yield 7.14%

Sold

ASX Portfolio

Good to see two of the stocks in the Sharesies Portfolio that had hit their exit thresholds appearing in the big movers list (Westgold and Appen). Seems the decision to hold on last week was the right one.

New Buys

Estia Health (EHE.AX): Aged Healthcare. Dividend yield 2.85%. Chart is showing the formation of a pennant on rising higher lows. Price is only 20% below 52 week highs - this sector is worth investing long term to get past that 52 week high.

Shorts

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. With price trading down to $101.10 (Mar 6) closed out 104.5 strike put option expiring Mar 10 for 120% profit in one month. The choice to roll down and out leaving just a put contract open was the good call last month. Replaced it this cycle with a 100/98 bear put spread. With a net premium of $0.73 this offers maximum profit potential 274% for a 3.2% drop in price. Will be watching the Federal Reserve with a close eye as we may have reached the top of the yield curve. If that is the case will convert this into a ratio put spread by selling another out-the-money put contract.

Quick update of the chart shows the new spread as red rays with the expiry the vertical green line on the right margin. Timing of the exit coincided with the reversal day with price making a big W move and reinforcing the sense that the yield curve may be topping out.

Hedging Trades

Vanguard European Stock Index Fund (VGK): Europe Index. Got that uncomfortble feeling in the week - not enough hedges apart from a large cash holding. With price trading down to $59.14 (Mar 9), put in place an April expiry 58/55 ratio put spread. The trade was not quite cash neutral with a net premium of $0.20. This covers a price drop of 2% to 7.5% which is a bit more than I normally do. Ideally price needs to land in the range of $57.80 and $55 to offer the best profits. I will find a way to get the trade to cash neutral - with Friday drop to $58.67, the bought put can be rolled down to 57 strike and recover the net premium.

Quick look at the chart which shows the bought put (58) as red ray and the sold put (55) as a dotted red ray with the expiry date the dotted green line on the right margin. Price has been consolidating and was likely to step higher. The contagion fear coming from US banking sector could produce a drop similar to the ones we saw before the start of the Ukraine war (the red arrow). The sold put (55) is below the last mini-consolidation and at the bottom of the red arrow price scenario

Cryptocurrency

No trades

Income Trades

Quiet week for income trades with only two covered calls written, both in US and one credit spread

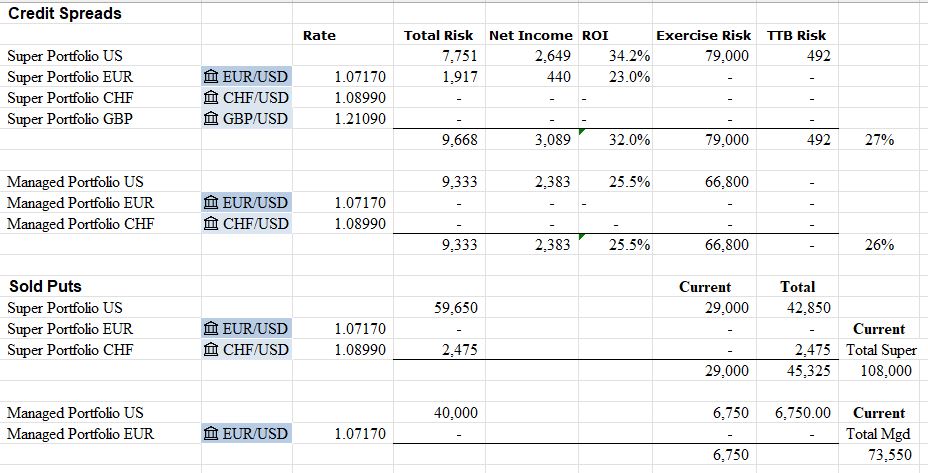

Credit Spreads

Vulcan Materials Company (VMC): US Building Materials. ROI 23.5% Coverage 4.3%

Big selloff days has changed the exercise risk profile quite dramatically. Of the 19 March expiry credit spreads open, three are trading TTB (QS, ABNB, CVS) and 11 at risk of exercise. Will make some adjustments to be sure there is margin in the portfolios to absorb the ones I am happy to exercise. One large naked put on American Waterworks (AWK) needs kicking down the road.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from DuckDuckGo Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

March 6 - 10, 2023

Posted Using LeoFinance Beta