Added to the monthly top ups in crypto and ASX. Adjusted a few naked puts to reduce margin pressure in the accounts and did some bottom fishing, mostly in Europe using stock screens.

Portfolio News

In a week where S&P 500 dropped 0.79% and Europe rose 0.14%, my pension portfolio dropped a more modest 0.57%. The drags were a few Australian resource stocks, banks in US and Europe and the biggest of all a 26% drop in Fiverr International (FVRR). Japan was the only region in the black (apart from financial stocks).

Big movers of the week were Bayhorse Silver (BHS.V) (+20%). Tilray Brands (TLRY) (+17.9%), Aurora Cannabis (ACB.TO) (+11.4%)

Two cannabis stocks on the list with the Safe Banking Act coming up for a vote in US Congress - maybe at last cannabis companies in US can use banking services everyone else can use

Markets were on the drift lower until the US jobs report suggested the economy is not in such a bad place.

Crypto Drifts

Bitcoin price tracked sideways all week in a tight band of 7.9% ending 1.3% lower.

Ethereum price pushed higher with a small test lower with a trough to peak range of 11.8% ending 1.4% higher.

The Top 10 coins are all showing weakness turning into the new week - sample Ripple (XRP) down 7% in one 4 hour bar.

Not one of the 30 or so coins held showed improvement relative to BTC or ETH.

Bought

UniCredit S.p.A. (UCG.MI): Italian Bank. Read an article about the changes made by the new CEO - added a small parcel to ride the momentum of the restructuring. Also added June expiry 18/16.5 credit spread with ROI 35.1% Coverage 2.33%. Dividend yield 5.23%. First Republic Bank bail out news broke after the trade - dragged the spread in-the-money. Good thing it is June expiry - time to trade back.

Derichebourg SA (DBG.PA): Waste Management. Averaged down entry price - original idea was a stock screen opportunity. Dividend yield 5.81%

Fomento de Construcciones y Contratas, S.A. (FCC.MC): Waste Management. Added to existing holding as stock appeared on stock screens. Dividend yield 4.42%

Axon Enterprise, Inc (AXON): Security Services. AAPlus added to their holdings. Added a first small parcel. Also added May expiry 210/200 credit spread with ROI 40.8% Coverage 3.1%.

Bank of America Corporation (BAC): US Bank. The pullback in banking stocks gives an opportunity to average down entry price a little. With JP Morgan bailing out First Republic Bank, the thinking is the US banking sector is going to polarize between the big banks and the small banks. Wrote June expiry covered call for 2.2% premium with 5.2% price coverage.

Banco Bradesco S.A. (BBD): Brazil Bank. Used the pull back to scale into the position. Wrote June expiry covered call for 2.8% premium with 5.8% price coverage. Price moved that much during the day to close above the sold strike.

Pan American Silver (PAAS): Silver Mining. Scale into the holding acquired with the acquisition of Yamana Gold (AUY) using proceeds from gold hedge. Dividend yield 2.23%. Will write covered calls,

Sold

iShares was CS Gold ETF Hedged CHF (CSGLDC.SW): Gold. Switched out a portion of long standing gold hedge to silver. Locks in a blended profit of 1.6% since July 2011/July 2013. The first tranche was at a small loss. Averaged down remainder is strongly profitable

Of note is the holding is hedged in Swiss Francs. The base currency for this portfolio is Euro which has declined 18.8% since the first tranche was bought - the hedge worked to produce a 1.5% return annually. The decline of the Australian Dollar in the same time was 33% - one beneficiary gets paid in AUD. The first tranche was added when first starting out the managed portfolio - allocated a small percentage to the gold hedge.

ASX Portfolio

Added another A$2000 to the fractional share portfolio and ran price screens over a few days. Process reminder. New buys ($200) are new entrants to stock screens. Top ups ($100) are stocks that make it to screens - currently only running one top up. Scale ins are stocks that have gone up 10% (or close to 10%). Sales are stocks that are plus 30% or at a 52 week high. Have been loose on cutting losses as market conditions dictate a little patience might be rewarded.

New Buys

Service Stream Limited (SSM.AX): Infrastructure Services. Dividend yield 1.44%

The chart shows price has been smashed with 5 earnings reports in a row giving poor outcomes (E marker has a red down shape) with the last one at last positive. The business is working on the NBN Broadband rollout which is scaling down.

Pilbara Minerals Ltd (PLS.AX): Lithium. Am already holding a large holding at huge profit in my pension portfolio. Added it tho this portfolio as it has made a one month high after a bit of a selloff.

Scale Ins

Infratil Ltd (IFT.AX): NZ Utility. Dividend yield 1.93%

Integral Diagnostics Limited (IDX.AX): Healthcare. Dividend yield 1.53%

Redeployments

Chose to redeploy some of proceeds of gold mining sale below to average down entry price on two other gold miners.

Aeris Resources Ltd (AIS.AX): Copper/Gold Mining.

Silver Lake Resources Limited (SLR.AX): Gold Mining.

Top Ups

Kogan.com Ltd (KGN.AX): Retail.

Bega Cheese (BGA.AX): Packaged Food.

Sold

Westgold Resources Ltd (WGX.AX): Gold Mining. 35.9% blended profit since January/February/March 2023. Sure pleased did not sell when stock was 30% down and retained as a hedging trade.

Shorts

Pfizer Inc (PFE): US Pharmaceuticals. Am currently holding a January 2024 expiry 40/30 ratio put spread to trade the potential for lawsuits spreading from the current case in South Africa and a class action suit filed in Australia. Chose to buy back the ratio part of the spread for a 35% profit since August 2022. Trade has 18 months to run to see the full impact of lawsuits and the ending of the Covid-19 pandemic.

Seems I am not alone in thinking short

https://www.investors.com/news/technology/pfizer-stock-buy-now/?src=A00220

Cryptocurrency

Did the monthly purchase of A$10k split 50% to Bitcoin, 25% to Ethereum, 25% to Solana - not a new comer to my holdings but new in this account.

Income Trades

Quiet week for income trades with five covered calls written (all US) and one expiry (US). Did adjust a few naked puts and added a few credit spreads

Credit Suisse X-Links Silver Shares Covered Call ETN (SLVO): Silver. Averaged down entry price using proceeds of gold hedge sale. Yield is a tidy 17.48% some of which is capital and offers a way to get paid for holding silver.

Naked Puts

AMN Healthcare Services (AMN): US Healthcare. AAPlus have been reducing their holdings as they fear staff shortages are going to impact profitability. Share price performance in recent weeks after the big selloff is not reflecting that with price finding support and consolidating. One has to believe that aged healthcare is a growth opportunity and as market conditions toughen elsewhere the staff shortages can be addressed

With price opening at $85.19 (May 4), kicked the can down the road on the May expiry strike 90 naked puts. Locks in a 18% profit on the buy back and was cash positive. Trade was made before the earnings release which surprised the markets.

https://finance.yahoo.com/news/amn-healthcare-services-amn-surpasses-235511619.html

The earnings release saw price pop 10% to trade around $95. That gave a good opportunity to close out the naked put and lock in a 47% profit on the buy back. That leaves a stock holding for the long run recovery of the stock. Will use covered call writing to let the market find an exit point. The last 3 kick the can down the road put trades have taken the put trades into positive territory. Now the wait for the covered calls.

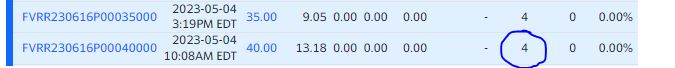

Fiverr International (FVRR): Internet Services. Share price tumbled during the week from Friday close of $36.52 (Apr 28) to May 4 open of $26.99. Kicked the can down the road on May expiry 40 strike naked puts. While the trade was just cash neutral did incur a 124% loss. Maybe time to bite the bullet and give up on the thought that the freelance gig market can ever get solid enough traction.

The driver seems to be the market reaction to education stock Chegg (CHGG) saying their customer growth has slowed since OpenAI launched ChatGPT. My sense is smart gig operators on the Fiverr network will start to harness ChatGPT for their services - work still needs to be done.

https://finance.yahoo.com/m/59991f48-4930-3049-aebc-1a961a8dbead/why-fiverr-upwork-and-wix.html

Seems I was alone in the market selling 40 strike put options

SES SA (SESG.PA): Satellite Broadcasting. With price rising during the week to open at €5.82 (May 5), kicked the can down the road on 6 strike naked put. Locks in a 64% profit on the buy back and was appreciably cash positive (even after high Paris Exchange trading costs). The market is steadily recovering the drop after the dividend payout date.

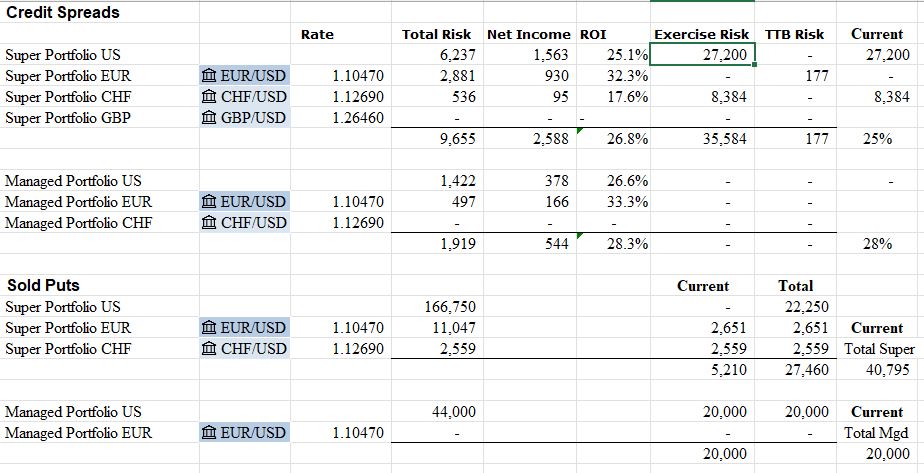

Credit Spreads

SPDR S&P Regional Banking ETF (KRE): US Regional Banks. Collapse of First Republic Bank has hit regional banking stocks hard. Price for this ETF has dropped 16% in a week to the $36.60 open (May 4). The contrarian instinct is the market has over-reacted. Put in place a June expiry 34/32 credit spread offering 36.8% ROI with 7.6% price coverage.

Adjustments made in the week and uptick in the market on Friday (May 5) improved the exercise risk profile dramatically - was looking ugly midweek - like 3 times uglier.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

May 1-5, 2023