Another week for adjusting credit spreads. Ran stocks screens to find new opportunities in Japan and Australia. Stepped up a few more lithium plays on the back of the big merger news.

Portfolio News

In a week where S&P 500 dropped 0.25% and Europe dropped 1.59%, my pension portfolio dropped only 1.05%.

Big movers of the week were Solis Minerals (SLM.AX) (+31.8%), Lifeist Wellness (LFST.V) (+28.6%), Latin Resources (LRS.AX) (+25.9%), Azure Minerals (AZS.AX) (+21.9%), Allkem (AKE.AX) (+21.7%), Barryroe Offshore Energy (BEY.L) (+19.3%), Lynas Rare Earths (LYC.AX) (+12.2%), Macmahon Holdings (MAH.AX) (+12%), Livent Corporation (LTHM) (+10%)

One clear theme in these movers - lithium and lithium processing (5 stocks).

Markets had eyes on the jobs number and the debt ceiling discussions - these always go down to the wire. Never good in options expiry week.

Lithium Merger

Livent (LTHM) and Allkem (AKE.AX) agree to merge their lithium interests. This brings together a large scale lithium materials processor (Livent) with a world scale lithium miner with operations in Australia, Canada and South America.

Produced a 15% pop in Allkem price though the Livent move was more muted. Brings a challenge to my pension portfolio as price has moved past the covered call written - take the profits and deploy eslewhere or buy back becomes the question. The moves in Allkem demonstrate the value and challenges of resource investing - first investment was in Galaxy Resources with its Mt Caitlin lithim mine in Western Australia in January 2013. Galaxy merged with Orocobre to form Allkem in August 2021. Latin Resources in the big movers list is shapoing up to be 8th largest lithium producer. That investment started as a South American copper investment - they still have the copper interests in Peru. .

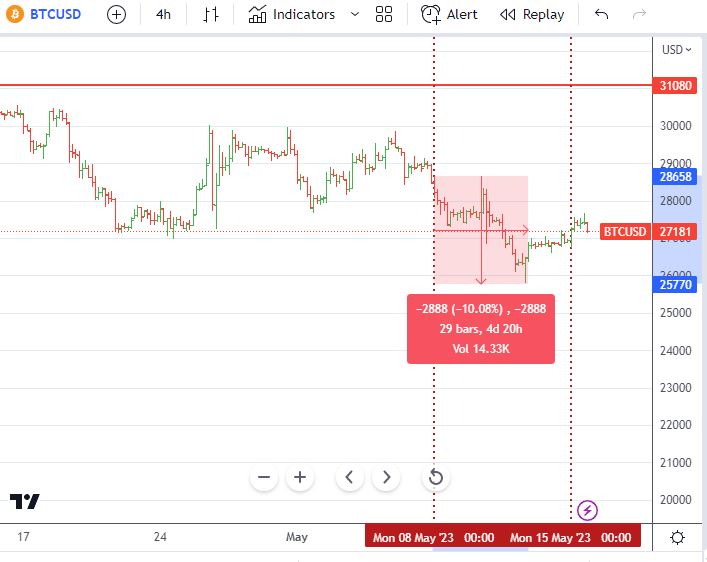

Crypto Drifits

Bitcoin price drifted lower to mid week and found buyers around $26k mark - peak to trough range at 10% and price ended the week 4.7% lower

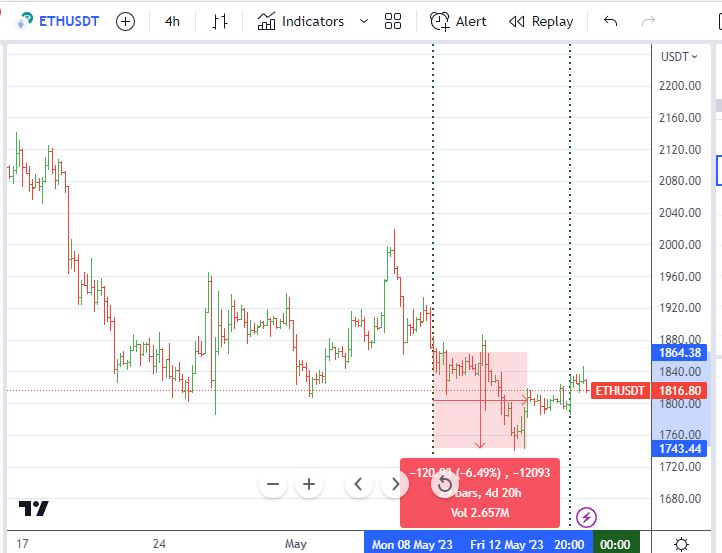

Ethereum chart looks much the same drifting lower to start with peak to trough range of 6.49% and ending 3.5% lower.

Litecoin found some buyers after selling off too and ending the week 3.7% higher

Celer Network (CELR) found buyers too with a 15% pop versus Bitcoin.

Bought

Gannett Co (GCI): US Media. Earnings this week came in ahead of expectations and price popped above covered call strike. As the holdings in all three portfolios were under water, took the chance to average down entry price and match holdings subject to covered call below covered call strike.

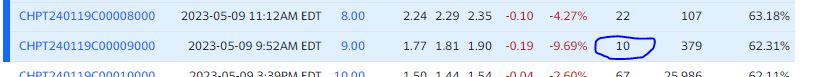

ChargePoint Holdings (CHPT): Electric Vehicles. AAPlus did a quick review - they like the long run prospects but warn of the high volatility. As I am already invested in the stock, explored using long range options trades. With price opening at $8.85 (May 9) was keen to find a strike close to that. There are options listed for April 2024 and January 2025 but the closest strike was $10. Put in place a January 2024 expiry 9/12/7 call spread risk reversal. With net premium of $0.91, the call spread offers on its own maximum profit potential of 229% for 35% move in price. The whole trade is cash positive with put coverage for 26% drop in price.

Let's look at the chart which shows the bought call (9) as a blue ray and the sold call (12) as a red ray and the sold put (7) as a dotted red ray with the expiry date the dotted green line on the right margin. The important part of the trade is the sold put (7) is below all the prices since listing. The next is the sold call (12) is below the last cycle high. The part to be wary of is price has not made a higher low to confirm the double bottom. As long as the balance sheet can carry the operating losses for the trade time, this could be a solid trade.

The options chain shows the two trades made as the day volume. Next day, made a further out in time trade in the pension portfolio buying a January 2025 10/15 call spread with net premium of $1.17 funded partially with November 2023 7 strike sold put. This ramps the profit potential to 1462% and reduces the risk period.

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread]

ENGIE SA (ENGI.PA): French Utility. Replaced stock assigned in February at 9.8% premium to assigned price. Price had been trading strongly into the ex dividend date (Apr 27) and dipped 6% Apr 27 close to Apr 28 close. Looking for price to rise back to the levels seen before the dividend. Meanwhile will earn from writing covered calls. Wrote May expiry covered call for 0.88% premium with 1.92% price coverage. Tight but it is for less than 10 days.

Axon Enterprise (AXON): Security Service. Price was hammered 15% during the earnings call despite a solid beat on the top and bottom line. Nibbled into another parcel on the weakness before AAPlus sent out their adding note. Also started the adjustment process on the 210/200 credit spread by selling the bought put (200) to recover premium for a 4.8% loss and putting on a pending order to roll down and out the sold put (210). The timing of that sale was really bad as I received only $4.00 per contract and close was $9.60 (May 10). This leaves a nasty naked put exposure. Did roll out the naked put (210) to June expiry 200 strike next day. Incurred a 46% loss on the buy back and was not cash neutral.

Shionogi & Co (4507.T): Japan Pharmaceuticals. Ran stocks screens to identify stock to replace Kamei sold below. Made a trade size error - got too much. Dividend yield 2.48%. Sold half to get size right for 12.1% profit next day.

Vulcan Energy Resources (VUL.AX): Lithium. Read an article a few days back about the European Critical Materials Act which looks to reduce the reliance on China (and elsewhere) on the supply of critical materials

The European Critical Raw Materials Act aims to strengthen EU’s critical raw materials capacities along all stages of the value chain. It also aims to increase our resilience by reducing dependencies, increasing preparedness and promoting supply chain sustainability and circularity. It has set out four pillars to achieve this.

Vulcan is developing lithium mining/processing capability in Germany. I have held off investing as Germany is notoriously slow in permitting projects like this. The EU Critical Materials Act changes that. Add in the Livent/Allkem merger announced this week - projects like this get new energy. Last factor is Vulcan completed an off market placement (May 4) at A$5.05. Bought a parcel of stock at less than that.

Livent Corporation (LTHM): Lithium. With price opening at $25.62, stock will be assigned at next options expiry. Replaced the stock and scaled in at 2.1% premium to likely assigned price. Given that Allkem price jumped 15% on the merger announcement, figured this has the same potential. Wrote covered call for 3.2% premium with 7.7% price coverage. Also added a June expiry 25/21 credit spread offering 32.9% ROI with 2.5% price coverage. Sold put strike is same strike as the covered calls that are likely to be assigned.

Sunrun Inc (RUN): Solar Power. Solar stocks have taken a hammering. Averaged down entry price. Wrote covered call for 1.7% premium with 29.7% price coverage. Coverage like that is a bit WOW.

Fiverr International Ltd (FVRR): Internet Services. Assigned early on naked put that has been kicked down the road a few times - one time too few it seems. Breakeven is $35.81 which is a 28% premium to $27.94 close (May 12).

Earnings came in 50% ahead of expectations - this was always going to be a long term hold in the portfolios

https://finance.yahoo.com/news/fiverr-international-fvrr-q1-earnings-110511355.html

Price has been hammered over the last few weeks following growth of ChatGPT and AI services. My sense is the AI growth does not change the Fiverr gig economy - the work still needs to be done and smart Fiverr sellers will leverage the technology and command continuing fees.

fool.com/investing/2023/05/11/fiverr-earnings-is-the-stock-a-buy-right-now/?source=eptyholnk0000202

Put some Bollinger Bands on a weekly chart and this does not look like a bad place to buy - sure hope so.

Sold

Kamei Corporation (8037.T): Japan Energy Marketing. Profit taking sale for 35.6% profit since September 2021. Of note in the same time frame, Yen has depreciated by 12% against Australian Dollar. Good thing the Yen exposure is hedged with a short Yen currency position.

J D Wetherspoon plc (JDW.L): UK Restaurants. Closed above 52 week high for 47% profit since February 2023. Original idea was a UK stock screeen pick.

ASX Portfolio

Kept plugging away at the fractional ASX portfolio based on stock screens. A quick reminder on the screens. 3 fundamentals, price to book, price to sales and price earnings and 3 technicals, one month high 20EMA above 50EMA and below 200EMA = looking for weak stocks breaking upwards

Started to extend top ups and scale ins to $400 holding ($200 entry plus two $100 tranches).

A disadvantage of this model is there are more adds than sells and the portfolio is getting large - 66 stocks.

New Buys

Monadelphous Group (MND.AX): Mining Services. Dividend yield 3.61%

St Barbara Limited (SBM.AX): Gold Mining. Two charts for this choice - price making a bit of a W off the lows

And a big lag behind Westgold (WGX.AX) sold a few weeks back - big like 50%

Downer EDI Limited (DOW.AX): Mining Services. Dividend yield 2.66%

Scale Ins

Bluescope Steel (BSL.AX): Steel. Dividend yield 2.56%

Regis Healthcare Ltd (REG): Healthcare. Dividend yield 1.75%

Top Ups

Mayne Pharma Group Ltd (MYX.AX): Pharmaceuticals.

Collins Foods Ltd (CKF.AX): Restaurants. Dividend yield 2.68%

Shorts

iShares MSCI France ETF (EWQ): France Index. Read a headline about 3 European markets - France, UK and Switzerland - the largest holdings in the Vanguard Europe ETF (VGK). The article is a bit sensationalist and not well thought through BUT it did get me thinking about France. The government is facing a lot of pressure on the pension reforms with rioters in the streets.

https://finance.yahoo.com/news/etfs-reflect-3-key-european-220000553.html

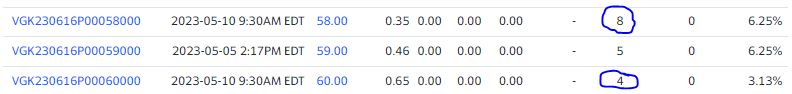

Mapped the 3 countries mentioned against the Vanguard Europe ETF (VGK - the bars). Despite all the troubles, France is outperforming the other two = set for a fall if they cannot resolve the crisis. Was keen to be short the stock with a bear put spread but the return was not good enough (74% for the bear put spread alone). Chose instead to use a cash neutral ratio put spread so that the trade is more of a hedging trade than a short trade.

Quick look at the chart which shows the bought put (38) as a red ray and the sold put (36) as a dotted red ray with the expiry date the dotted green vertical line on the right margin. The price scenario comes from one of the drops after the Ukraine war started (left hand red arrow) - get a repeat of that and this trade will need adjustment to get rid of the ratio. A week later and the open trades are still the only open interest.

Hedging Trades

Vanguard European Stock Index Fund (VGK): Europe Index. With price opening at $63.20 (May 10) put in place a June expiry 60/58 ratio put spread. This offers protection for a price drop between 5.3% and 8.9%. Trade was cash neutral.

Quick look at the chart which shows the bought put (60) as a red ray and the sold put (58) as a dotted red ray with the expiry date the dotted green vertical line on the right margin. Last time price track sideways in a consolidation, there was a small correction - the left hand red arrow. Get a repeat of that and the hedging trade will succeed

Option chain shows the trade is the total volume for the day

Cryptocurrency

Element Bought an Element smart node licence a few months back. Somehow, I landed up with 2 nodes licensed - deployed the 2nd one this week. Runs on a VPS at $5 a months. Earns ELMT at a healthy rate - not worked out yet what the value is. Element is a bit way out there - aim is to digitize assayed mine assets and leave them in the ground.

Income Trades

Covered Calls

Woodside Energy Group (WDS.AX): Australian Oil. New budget is being presented Tuesday (May 9) and is slated to include a hime in tax for oil and gas producers. Rather than sell the stock, which is in profit, chose to write really tight covered calls. Wrote May expiry covered call for 1.77% premium with 0.95% coverage.

The tax hike is disappointing as there is a chance it will scupper Woodside plans to develop the Browse offshore field in Western Australia. Those plans came back onto the front burner when Shell (SHELL.AS) sold their JV stake to BP (BP.L) last week.

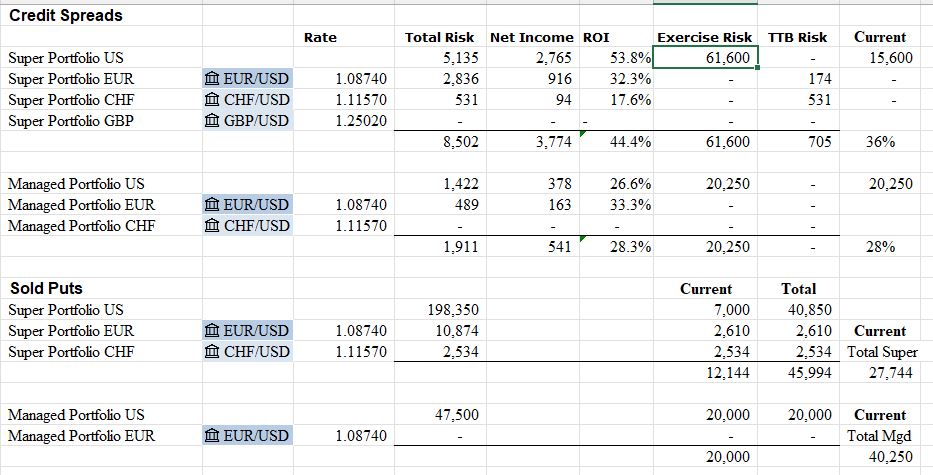

Wrote seven covered calls across the portfolios (UK 1 Europe 1 US 5) and one new credit spread in US

Credit Spreads

Lockheed Martin Corporation (LMT) With price opening at $452.81, 455/435 credit spread is at risk of exercise. Given the high ticker price, exercise will create margin problems. Rolled down and out the sold put (455) To June expiry 450 strike. 55% loss on buy back but trade was hugely cash positive

Elevance Health (ELV): US Healthcare. With price opening at $458.82 (May 11), 460/450 credit spread is at risk of exercise. Rolled out the sold leg (460) for a 7.5% loss to leave a reverse diagonal put spread. As the portfolio holds stock, the bought put is now a protective put to hedge the long position and the sold put is a naked put looking to create a lower breakeven. Trade was hugely cash positive and ramped up ROI to a staggering 1076%. Risk in the trade now is for price to stay above the bought put level (450) till May expiry.

Bank of America Corporation (BAC): US Bank. AAplus added to their holdings into weakness. That weakenss is taking the 29/27 credit spread toward TTB level (through the bottom). Chose to close out the credit spread to bank the long put premium (and a small profit) and to kick the can down the road on the sold put (29) - if AAPlus are happy to buy, so am I. Taking last month's results into account, exercise at 29 will bring a breakeven entry of $27.53, a 1.7% premium to $27.09 close (May 12).

Actions taken to adjust the credit spreads at risk of exercise kept available funds within margin limits

Currency Trades

Japanese Yen (AUDJPY). Broker does not allow long Yen cash holdings. the sale of Kamei was translated to Australian Dollars. Transferred those out to fund next two months pension payments.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

May 8-12, 2023