Always good to have a quiet week coming into options expiry. No need to panic and no need to do anything other than let options run and buy lithium

Portfolio News

In a week where S&P 500 rose 1.71% and Europe rose 0.67%, my pension portfolio rose a more modest 0.41%. Biggest drag was a 5% drop in largest portfolio holding - De Grey Mining (DEG.AX)

Big movers of the week were Aurora Cannabis (ACB.TO) (+18.7%), Zinc of Ireland (ZMI.AX) (+15.4%), Marvell Technology (MRVL) (+13.3%), Mipox Corporation (5381.T) (+12.3%), Dawson Geophysical (DWSN) (+11.3%), Summerset Group Holdings (SNZ.AX) (+11.1%), Air France-KLM (AF.PA) (+10.6%), Cronos Group (CRON) (+10.4%)

This is a mixed bag of movers. Hard to pick out any themes in this list other than progress on Safe banking Act in Congress and legalization of cannabis in Minnesota lifted cannabis stocks. The diversity of the lists suggests a mostly sideways week for markets.

Markets were nervous all week

The debt ceiling is the culprit. They always find a way but they do like to call the lines tight - we all know how they position this. It is not for our benefit.

Crypto Drifts

Bitcoin price pushed higher for one day and then drifted lower with a peak to trough range of only 4.8% ending 2.3% lower

Ethereum chart is much the same - a little higher to start and then drifting lower with a peak to trough range of 4.1% and ending 1.5% lower

Litecoin again showeed some legs with a run of 12% from the open and ending 8% higher.

Injectve Protocol (INJBTC) made its reversal and popped 23% - have been looking to re-enter below the last exit.

Ripple (XRPBTC) bounced on new evidence emerging in the SEC case - not really new evidence but stuff lost down at Exhibit 220 of the evidence dossier.

Celer continued the run from the week with another 18% run before dropping back to end the week level.

Bought

**BASSAC S.A. (BASS.PA): France Real Estate. Ran Europe stock screens - liked the shape of the chart and the dividend yield with record date this week. Dividend yield 4.90%. The size of the dividend at record date did smack the price

Vulcan Energy Resources (VUL.AX): Lithium. Price keeps sagging - added another half parcel to average down entry price - figuring this could sag more. Will keep an eye on this as Europe does want Europe sourced lithium

UBS Group (UBSG.SW): Swiss Bank. Assigned early on 18.6/17.2 credit spread. With price closing at SFr17.35 (May 17), looks likely that the whole tranche will be assigned. Breakeven is SFr18.39 (6% premium). Could not buy back the bought put as the day the trade went on was a Swiss holiday. The whole tranche was assigned

ThyssenKrupp AG (TKA.DE): Europe Steel. Assigned early on 7.2/6.7 credit spread. Closed out protective bought puts for small loss plus trading costs. Breakeven is €7.04 which is a 2.9% premium to €6.84 closing price (May 17). Wrote covered call for 2.6% premium with price coverage to breakeven of 2.27% . One more month of covered calls and that loss will be covered

Fiverr International (FVRR): Internet Services. Assigned early on June expiry naked put in pension portfolio. Surprised me somewhat as exercise does not early come that early. Breakeven is around $30.24 - a 6.4% premium to $28.40 close (May 18). As there is still a tranche open, this is an estimate. Price has been improving since the dramatic fall when the market was spooked last week by the risk of AI to the business. As it happens all the contracts were exercised early - a long haul on this.

Koninklijke Philips (PHIA.AS): Medical Devices. Topped up to round number after dividend reinvestment plan completed. Wrote covered call for 1.4% premium with 5.3% price coverage.

ChargePoint Holdings (CHPT): Electric Vehicles. Assigned on 8/7 credit spread with price dipping below sold strike on the last day. Breakeven $7.78 vs $7.93 close.

Sold

Fresenius SE (FRE.DE): German Healthcare. Assigned early on covered call for 5.2% profit since April 2023. Trade idea came from running Europe stock screens.

Air France-KLM (AF.PA): Europe Airline. Assigned on covered call for 3.6% loss (including trading costs) since February 2023. Income trades since this tranche was bought have covered this capital loss but not overall since first entering Air France. Might have copped a bullet here with French Government banning all flights less than 2 and a half hours where there is a train service that could be used

Gannett Co (GCI): US Media. Assigned on covered call for 3.2% profit since May 2023. Action taken to adjust the trade by buying stock on the dip two weeks back produced the profit. Will look to replace the stock to keep the averaging down process running.

Banco Bradesco (BBD): Brazil Bank. Assigned on covered call for 7.3% profit since April 2023. Stock idea came from stocks screens.

ThyssenKrupp AG (TKA.DE): Europe Steel. Assigned on covered call for 11.4% profit since April 2023. Profit comes from an averaging down trade made last month during market weakness.

AMN Healthcare Services (AMN): US Healthcare. Assigned on covered call for 10.7% blended loss since August 2022/January 2023. AAPlus exited their position a while back. Have been using covered calls to find a mrket exit point. While there was a capital loss, income trades have covered that loss 4 times. Selling puts was not enough to cover the whole capital loss.

Global X Autonomous & Electric Vehicles ETF (DRIV): Autonomous Vehicles. 5.5% blended loss since Sepetmebr 2023. Still have a holding at a lower entry price. Will replace the stock as assigned price was only a little lower than current price.

Marvell Technology Group (MRVL): US Semiconductors. 3.7% blended profit since March/April 2023. AAPlus idea. Also won on the credit spread.

ASX Portfolio

No trades in the week

Expiring Options

Hedge trades on Invesco QQQ Trust (QQQ) and SPDR S&P 500 ETF Trust (SPY) expired out-the-money. Booked small profits on each trade as hedges were set up as ratio put spreads. No adjustments were needed.

iShares MSCI Emerging Markets ETF (EEM): Emerging Markets. With price closing at $38.98, the sold put funding a September 2023 45/50 bull call spread expired. Will look to write another naked put to get the net premium lower.

Hedging Trades

Pan American Silver (PAAS): Silver Mining. Assigned early on 18/16 credit spread. With price closing at $16.29, looks likely that the whole tranche will be assigned. Closed out the protective puts for 77% profit. Breakeven $17.08 (4.8% premium). Wrote covered call at same strike for 0.86% premium at 5.3% coverage to brekeven

iShares Silver Trust (SLV): Silver. Assigned on 22.5/21.5 credit spread. Sold the bought put at market open - someone was happy to run the risk for one trading session of price dropping more than 1 percent - it went up 1.39%. Breakeven after 12 months income trades is $18.47 = a healthy hedging profit machine. Wrote covered call for 1.75% premium with 2.9% price coverage. Getting paid to hedge.

Cryptocurrency

The Graph (GRTETH): Averaged down entry price of holding when price broke the downtrend and confirmed the reversal - sure hope this is not another false break.

Originating from Ethereum, The Graph is a decentralized system for indexing and querying data from blockchains. It enables users to query data that would be hard to obtain normally.

Income Trades

Six covered calls went to assignment at expiry (Europe 3 US 3) and three naked puts assigned (all Europe). Only five new covered calls written (Europe 2 US 3)

Naked Puts

Bank of America Corporation (BAC): US Bank. With price opening at $27.74 (May 17) kicked the can down the road on June expiry 29 strike sold put. Locks in 33% profit on the buy back and was strongly cash positive. BAC announced a $0.88 cash dividend with ex dividend date of June 1 which pushed price up 4.4% to close at $28.57. Will look for early exercise opportunity closer to the record date.

Banks got off to a rocking start on Wednesday thanks to the latest news from the supposedly vulnerable Western Alliance (WAL 10.19%). The company said that its deposit base has grown by $1.8 billion on a quarter-to-date basis, and by $600 million since May 2

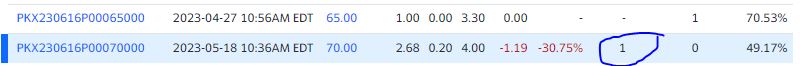

POSCO Holdings (PKX)": Korean Steel. With price opening at $69.65, kicked the can down the road on a 70 strike naked put to preserve margin in the account. Incurs a loss of 17% on the buy back but was net-net cash positive. Totally happy to buy the stock at $67.56 breakevn as that is below the current trade price. There is a dividiend date coming up in late June - will look to be long the stock by then. The trade idea is to get access to lithium interests Posco bought from Galaxy Resources in Argentina.

Only me on this trade

Credit Spreads

Eight credit spreads were still open with May expiries of which two went to exercise (US 4 (1) Europe 4 (1))

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

May 15-19, 2023