Delayed Posting: Been Sick. A busy options expiry with all the action coming in assignments of covered calls. Timing is good - just feels a good time to be holding a bit more cash, while the markets decide which way to go and whether recession is coming, especially Europe

Portfolio News

In a week where S&P 500 rose 2.22% and Europe rose 2.88%, my pension portfolio rose only 0.95%. The drags were Europe and UK - stocks being held are not really representative of the broad market.

Big movers of the week were Azure Minerals (AZS.AX) (+100%), Barryroe Offshore Energy (BEY.L) (+64.3%), Stroud Resources (SDR.V) (+45.4%), Solis Minerals (SLM.AX) (+31.4%), Cobalt Blue Holdings (COB.AX) (+17.4%), Solid Power (SLDP) (+16.8%), JinkoSolar Holding Co (JKS) (+14.1%), Panther Metals (PNT.AX) (+13.3%), Azincourt Energy Corp. (AAZ.V) (+12.5%), Kairos Minerals (KAI.AX) (+11.8%), Vulcan Energy Resources (VUL.AX) (+11.7%), PostNL (PNL.AS) (+11.6%)

One theme stands out - materials for batteries (lithium, copper, cobalt, zinc, nickel). Barryroe is an anomlay - someone was able to offload a parcel of shares - there is not news about the working capital situation mentioned last week.

Last week I wrote that Europe and US may be diverging. The data did not support that. The headline for the week was the one about the markets betting against the Federal Reserve. Markets do not want to have anything to do with the desire for softer markets, especially amongst tech stocks.

Crypto Busts?

Bitcoin drifted lower to start the week and then found buyers finishing up 2% on the week with a trough to peak range of 7.7% = about standard.

This headline explains some of the recovery

Ethereum chart looks much the same with a slightly wider trough to peak range of 8.9% but ending the week 1% lower.

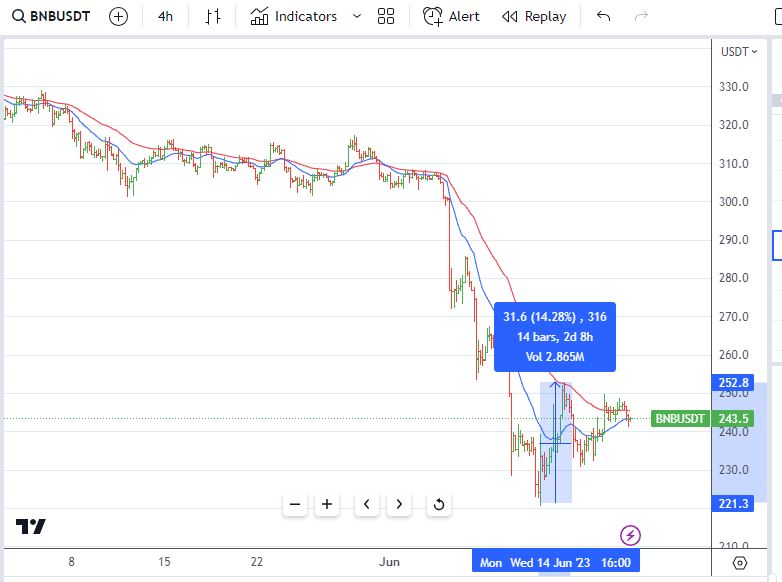

Binance Coin (BNB) found some buyers with a move up from the lows of 14%.

The driver for that was they reached a deal with the SEC about not doing the asset freeze and repatriating Binance US customer assets to the US

What is clear is there is a move to the relative safety of Bitcoin and Ether - pick any coin against BTC and the charts look the same - using Cardano as an example as it is near the top of the alphabet.

Bought

Ran stock screens across a range of markets in Europe and US.

Arcelor Mittal (MT.AS): Europe Steel. Holding in Thyssenkrupp (TKA.DE) could go to assignment at options expiry. Chose to replace with Arcelor as it appeared on the stock screens. Dividend yield 1.56%. Wrote covered call for 1.44% premium with 5.3% price coverage.

Then along pops this headline - same day - Ukrainian steelmaker and longs producer ArcelorMittal Kriviy Rih (AMKR) recently stopped steelmaking and rolling operations.

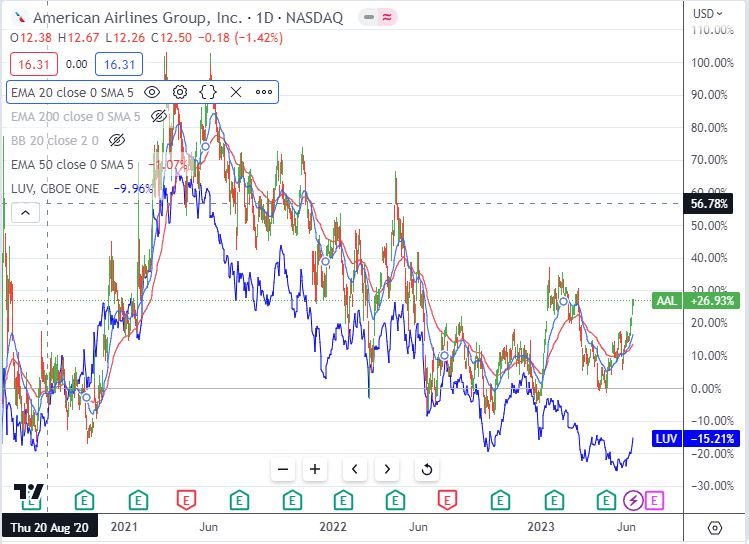

American Airlines Group (AAL): US Airline. American popped up on stock screens making a one month high and 20 day moving average coming above 50 day from below. Dividend yield 5.12%. Wrote covered call for 1.17% premium with 11.2% price coverage.

Have put in a price comparison chart with another airline bought recently - Southwest Airlines (LUV - blue line). American has had one go at breaking the downtrend and has one pullback which may now be being reversed. Southwest has not confirmed the break of the downtrend.

First Horizon Corporation (FHN): US Regional Bank. Stock screen offered up First Horizon, which was hammered when the TorontoDominion (TD) merger was cancelled. Added a small parcel to trade the road back for the next acquirer. Price pop was partly to do with First Horizon being added back to the banking index

Not sure why the stock appeared on the screens as it should only deliver stocks with 20 EMA higher than 50 EMA. Detail digging shows the filter has changed somehow - finger trouble. At least price did make a one month high. Dividend yield 5.12%. Wrote covered call for 1.72% premium with 12.1% price coverage.

Chart shows the impact on FHN share price of the TD deal - a huge pop when deal was announced and then the collapse when the deal was called off. Price was already under pressure with the collapse of Silicon Valley Bank in March 2023. TorontoDominion cite regulatory pressures were the reason for calling off the deal. I would suggest that the SVB collapse increased the regulatory pressures as they were about money laundering controls not being adequate. Somebody knew something. FHN did earn a massive break fee which will bolster capital reserves.

Denison Mines Corp (DML.TO): Uranium. Holding in Cameco (CCJ) is likely to be assigned in one portfolio - added a holding of an alternate Canadian uranium explorer (see https://mclnks.com/tib659 for the rationale)

ING Groep N.V (INGA.AS): Dutch Bank. ING appeared on stock screens. Added a small holding in on portfolio. Dividend yield 4.57%

KraneShares Electric Vehicles and Future Mobility Index ETF (KARS): Electric Vehicles. With price opening at $31.46 covered call will be assigned at options expiry. Holding in iShares Self-Driving EV and Tech ETF (DRIV) will also go to assignment. Keen to stay invested especially given price momentum on Tesla (TSLA). Replaced stock at 1.45% premium to assigned price - will recover that in two months of covered calls. Wrote covered call for 0.47% premium with 4.9% price coverage.

Fresenius SE & Co. (FRE.DE): German Healthcare. Averaged down entry price. Wrote covered call for 0.87% premium with 6.4% price coverage.

Elevance Health Inc (ELV): US Healthcare. AAplus added to their holding on a big down day - market over-reacted to guidance from one of the other healtchare providers. Added a small parcel - am already invested and well under water - averages down a little.

Robinhood Markets (HOOD): Financial Markets. Price has been on a bit of a yo-yo ride above and below covered call strike price. Was above when I placed the order and traded below. If stocks gets assigned it will be at a small profit - stock was assigned with price closing just above the sold strike (10). Robinhood is also caught in the SEC crypto securities saga. Also added July expiry 9/8 credit spread with 16.3% ROI with 9.1% price coverage. Wrote covered call for 2.7% premium with 10.6% price coverage.

Sigma Lithium Corporation (SGML): Lithium. Saw a tweet about another Braizil lithium opportunity. Added a small parcel of stock in one portfolio. There is huge risk in following ideas like this as they invariably emerge after the move happens. I am keen though to spread the lithium investments by region.

Chart builds on stuff I wrote last week about Latin Resources (LRS.AX - the bars) comparing to the other lithium stocks in the portfolios. Sigma (dark blue line) is 32 percentage points behind LRS but ahead of Pilbara Minerals (PLS.AX - light blue line) and Allkem (AKE.AX - yellow line). Chose the Nasdaq listing as there is a reasonably liquid options market. Wrote covered call for 1.6% premium with 11.7% price coverage.

UBS Group (UBSG.SW): Swiss Bank. UBS completed the acquisition of Credit Suisse Group (CSGN.SW) - 100 shares issued for every 2248 shares. Going to be a long road to recover from this one but I guess it is better than the whole thing going bankrupt and getting nothing. June expiry Credit Suisse sold put assigned also - starts off life at a 832% loss - good thing it was only 12 shares. There is a bit of irony in here - in my professional career I worked for two Swiss banks - Swiss Bank Corporationa dn Creit Suisses - both are now inside the one I did not work with (UBS).

Sold

A raft of covered calls went to assignement

Petróleo Brasileiro S.A. (PBR): Brazil Oil. Assigned on covered call for 5.26% profit since April 2023. Initial trade was stock screen pick.

KraneShares Electric Vehicles and Future Mobility Index ETF (KARS): Electric Vehicles. Assigned on covered call for 17.3% loss since August 2022. Remain invested (see above).

Thyssenkrupp (TKA.DE): Europe steel. 0.3% blended profit since April/May 2023.

Bank of America Corporation (BAC): US Bank. 4.8% blended profit since March/May 2023 and 2% profit in managed portfolio since March 2023.

Banco Bradesco S.A. (BBD): Brazil Bank. 6.8% blended profit since April/May 2023. Idea came from stock screens. In small managed portfolio profit was 7.2% in 3 weeks.

Carnival Corporation (CCL): Cruise Line. 8.6% profit in a few days - stock idea came from following travel theme. Price closed (Jun 16) another 16% higher.

First Trust NASDAQ Cybersecurity ETF (CIBR): Cybersecurity. 8.2% profit since January 2023. AAplus idea. In managed portfolio trade produced a blended breakeven result since September 2022/March 2023. Averaging down in March helped.

Coty Inc (COTY): US Personal Care. 13.7% blended profit since February/March 2023. AAplus idea.

Global X Autonomous & Electric Vehicles ETF (DRIV): Electric Vehicles. 13.6% profit since October 2022. Sold half the holding only after a top up in May 2023.

Ford Motor Company (F): US Automotive. 8.9% blended loss since July/August/September 2022. AAPLus idea which they started educing this week into strength. 2 of the 4 tranches would have been profitable at Friday close (Jun 16). Covered calls recovered 75% of the capital loss

Commerzbank AG (CBK.DE): German Bank. 2.8% profit in two weeks.

Airbnb, Inc (ABNB): Travel Services. Small blended profit of 0.009% since February/June 2023. Profit eaten away by traidng costs making a small loss. Averaging down helped. Credit spread written in the month expired profitably.

Cameco Corporation (CCJ): Uranium. 16% profit since March 2023.

Southwest Airlines (LUV): US Airline. 4.9% profit since May 2023. The travel theme has worked well over the last 3 weeks.

ASX Portfolio

Process reminder - add stocks to ass the stock screens in $200 lots for new buys. Top up also pass stock screens. Scale ins are stocks that are showing signs of winning around the 10% growth level. Exits are based on proximity to 52 week high or 30%

New Buys

MA Financial Group Ltd (MAF.AX): Financial Services. Dividend yield 2.83%

Temple & Webster Group Ltd (TPW.AX): Internet Retail.

Scale Ins

Fortescue Metals Group (FMG.AX): Iron Ore. Dividend yield 9.03%

Top Ups

Service Stream Limited (SSM.AX): Infrastructure Services. Dividend yield 1.34%

Mayne Pharma Group Ltd (MYX.AX): Pharmaceuticals.

Downer EDI (DOW.AX): Mining Services. Dividend yield 2.71%

Sold

McMillan Shakespeare Limited (MMS.AX): Mining Services. Profit target set as price passed 52 week high hit for 21.1% blended profit since August/November 2022/April 2023.

Shorts

Pfizer Inc (PFE): US Pharmaceuticals. With price closing at $40.06, 37.5 strike short put funding a January 2024 40 strike long put expired in my favour.

Quick update of the chart which shows the bought put (40) as a red ray and the sold put, just expired as a dashed red ray. Will write an August expiry sold put at the same strike to get the breakeven lower. Ideally one would write those sold puts below the last reversal - premiums are not interesting enough.

Hedging Trades

SPDR S&P 500 ETF Trust (SPY): US Index. With price closing at $439.46, 395/382 ratio put spread expired in my favour. As it was a ratio put spread, made a small profit

Quick update of the chart shows that there was no way the blue arrow price scenarios were going to play out. The market is fighting the Fed and wants to go up. Next place to be looking for hedging is somewhere at the top of the yellow arrow price scenario.

Vanguard European Stock Index Fund (VGK): Europe Index. With price closing at $63.28, 60/58 ratio put spread expired in my favour and was only tested once. This price move is worth watching closely as it is testing the top of he previous move - could well correct from here

Cryptocurrency

Receieved notification from my bank that they are instituting a "scammer test" for all payments made to crypto exchange.

I was caught in this before the announcement was made the week before - clueless customer service.

Income Trades

70 covered calls went to expiry with 17 assigned (UK 2 Europe 23 (2) US 45 (15)). For the next month 10 new covered calls written (Europe 1 US 9)

Naked Puts

iShares MSCI Emerging Markets ETF (EEM): Emerging Markets Index. With price opening at $41.09, June expiry sold put (38) will expire worthless. Sold a july expiry put option at higher strike (39). This funds a September expiry 45/50 bull call spread - will need one more cycle to get the spread fully funded. With markets diverging the way they it is hard to see price moving up another 10% to go in-the-money.

Credit Spreads

QuantumScape Corporation (QS): Battery Technology. ROI 36.5% Coverage 9.4%

Bank of America Corporation (BAC): US Bank. ROI 29.9% Coverage 0.4%

Carnival Corporation (CCL): Cruise Line. ROI 33.% Coverage 7.6%

POSCO Holdings Inc. (PKX): Korean Steel. ROI 4.7% Coverage 8.1%

Robinhood Markets (HOOD): Financial Markets. ROI 16.3% Coverage 9.1%

HelloFresh SE (HFG.DE): Europe Restaurants. ROI 32.5% Coverage 3.4%

Commerzbank (CBK): German Bank. ROI 27% Coverage 3.3%

KION GROUP AG (KGX.DE): Agricultural Equipment. With price trading down to €32.60, closed out the June expiry 34/32 crdit spread. Sold the bought put (32) and rolled down and out the sold put (34) to a lower strike. Roll out is cash positive and credit spread trade sequence since April is at breakeven. With all income trades accounted for breakeven if the sold put (33) is assigned is €30.32 = good coverage.

Options expiry saw all remaining credit spreads go to expiry safely. Timing was good as there was some margin pressure buidling if a few went to assignment

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

June 12-16, 2023