Alternate energy and Japan begin to power ahead. Topped up uranium holdings and shuffled Japan stocks.

Portfolio News

In a week where S&P 500 rose 0.98% and Europe rose 0.44%, my pension portfolio rose a handsome 2.19%. Big value contributions come from 3 of the ASX stocks (lithium and oil in the list below), Japan financials, and lithium and nuclear power in US.

Big movers of the week were CanAlaska Uranium (CVV.V) (56.6%), Cue Energy Resources (CUE.AX) (56.2%), Blue Star Helium (BNL.AX) (33.3%), NuScale Power Corporation (SMR) (32.7%), Global Oil & Gas (GLV.AX) (31.2%), Appen (APX.AX) (26.4%), APM Human Services International (APM.AX) (26%), North Pacific Bank (8524.T) (23.3%), Bayhorse Silver (BHS.V) (22.2%), Vulcan Energy Resources (VUL.AX) (21.2%), Aeris Resources (AIS.AX) (21%), Starr Peak Mining (STE.V) (20.5%), Norwegian Cruise Line Holdings (NCLH) (19.3%), Pilbara Minerals (PLS.AX) (19.3%), Kairos Minerals (KAI.AX) (16.7%), Stroud Resources (SDR.V) (16.7%), Latin Resources (LRS.AX) (15.8%), VHM Limited (VHM.AX) (15.7%), Arcadium Lithium (ALTM) (15%), Sagalio Energy (SAN.AX) (14.3%), Lotus Resources (LOT.AX) (13.1%), DevEx Resources (DEV.AX) (13.1%), NexGen Energy (NXE) (13%), Mipox Corporation (5381.T) (12.9%), G8 Education (GEM.AX) (12.4%), Pepper Money (PPM.AX) (11.7%), Evolution Energy Minerals (EV1.AX) (11.1%), Denison Mines (DML.TO) (10.6%), GoGold Resources (GGD.TO) (10.1%)

A big list of 29 big movers for the week. It was like the market woke up to the big themes in the commodity space - oil (3), uranium (5), lithium (6), gold/silver mining (5), oter alternate energy (3). Biggest movers of the week based on high grades in urnium drilling in Athabasca and maiden dividends from Cue Energy. Quite a few takeover targets and solid earnings results too.

US markets started the week a little cautiously but were propelled to news highs on the back of tech stocks by Friday.

Crypto booms

Bitcoin price just kept motoring to end the week 22% higher with a range of 25.6% - awesome

Ethereum price was a bit more sedate after stating its run earlier the week before ending 11% up with a triugh to peak range of 15.6%. Made for 28% rise over 2 weeks.

Many of the altcoins got a bid - Polkadot up 30%

EOS up 44%

Shiba Inu (SHIB) up 151% - still well shy of my exit target

Now for a few compared with Bitcoin - Enjin up 42% at one stage

Arweave (ARBTC) popping 106%

Cronos (CROUSDT) up 83%

EOS up 44% after recovery of tokens hacked.

Fantom (FTMBTC) popping 57% and heading toward my exit target from last entry

Holo (HOTETH) popping 78% and passing previous high and grabbing the exit on the way.

Bought

Aurora Cannabis (ACB.TO): Canadian Marijuana. Rounded up holdings in each portfolio after stock split to average down and to start writing covered calls. Feels like a "go bust or go home" trade idea.

Barclays Group plc (BARC.L): UK Bank. Barclays increased dividend which popped share price above covered call strike price. With an ex date of Feb 29, there is a chance the covered calls will be assigned early. Replaced stock that could be assigned at a small premium to assigned price (1.55) plus £0.053 dividend. Will recover that premium in maybe 2 months of covered call writing.

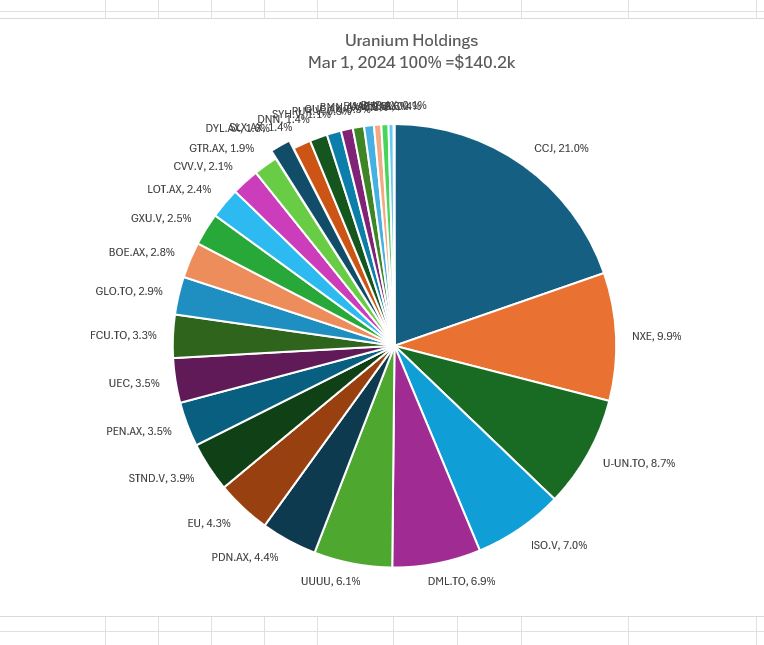

A busy week for uranium trades. Did do the analysis of holdings by portfolio and compared them to the Uranium Insiders focus list. That way can model each of the 3 larger portfolios along much the same lines - strategy is along the lines of a core holding in Cameco (CCJ) for the long haul (up to 20%); 60 to 70% invested in the core list and leaving 10 to 20% for more speculative opportunities and some options trades.

Cameco Corporation (CCJ): Uranium. Added to personal and managed portfolios early in the week to capute the pullback in price. Wrote covered call for 1.05% premium with 10% price coverage. If price wants to move 10% in two weeks, happy to be taken out.

Assigned early on naked put in personal portfolio at 17.5% premium to the last entry - going to need a long view to recover that - not worried about it.

Topped up a few holdings in managed portfolio to align with the emerging strategy.

enCore Energy Corp (EU): Uranium. Am using the US listing as it has an options market. Will sell the Canadian holdings when they hit 52 week highs.

NexGen Energy Ltd (NXE): Uranium. Wrote covered call for 1.48% premium with 18.2% price coverage.

Pension portfolio has the largest concentration of speculative uranium holdings but still under-invested compared to the 10% target. Added from the core focus list

Global Atomic Corporation (GLO.TO): Uranium. Dasa Project, Niger. First production 2026

Denison Mines Corp (DNN): Uranium. JV with Orano in Athabasca Basin from 2025 and own Phoenix project from 2028

GoviEx Uranium Inc (GXU.V): Uranium. Madaouela, Niger from 2026

Skyharbour Resources Ltd (SYH.V): Uranium. Explorer in Athabasca Basin - a takeover potential.

Sprott Physical Uranium Trust Fund (U-UN.TO): Uranium. Direct connection to physical spot price trading at large discount to net asset value

Now for the weekly summary chart - 100% is now $140.2k - increase coming from increased holdings rather than price increases.

The mix is better quality opportunities now accounting for 65% of holdings or more directly attached to the uranium price. The plan is now to consolidate the lesser quality names into the focus list as and when they reach price milestone (52 week highs) and thus get down to around 15 stocks (looking a bit more like the ETF's where top 15 holdings typically cover 85% of the holdings).

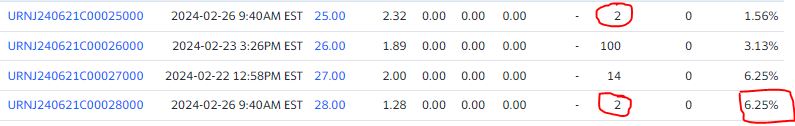

Sprott Junior Uranium Miners ETF (URNJ): Uranium. With price opening at $23.78 put in place a 25/28/21 call spread risk reversal.

Bought 25/28 bull call spread for $1.04 net premium which offers maximum profit potential of 669% for 38.8% price move. Funded that premium fully selling a 21 strike put option with 11.7% price coverage. Breakeven should that sold put go to exercise is $20.70.

Let's look at the chart which shows the bought call (25) as a blue ray and the sold call (28) as a red ray and the sold put (21) as a dotted red ray with the expiry date the dotted green line on the right margin. Price scenario chosen is the 2nd leg up after teh start of the last cnsolidation. Repeat of that and trade will reach the top of the spread. The sold put (21) is at the bottom of that last copnsolidation with breakven should it go to exercise the dashed green ray completely below. It would be possible to lever this trade up a bit more by selling a put closer in (say 22 or even 23) and widen the spread (as high as 30)

Options chains show this was the volume for the day on all 3 legs - implied volatility of 6.25% is crazily low with the low liquidity. Broker paid commission to me for the trades.

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread]

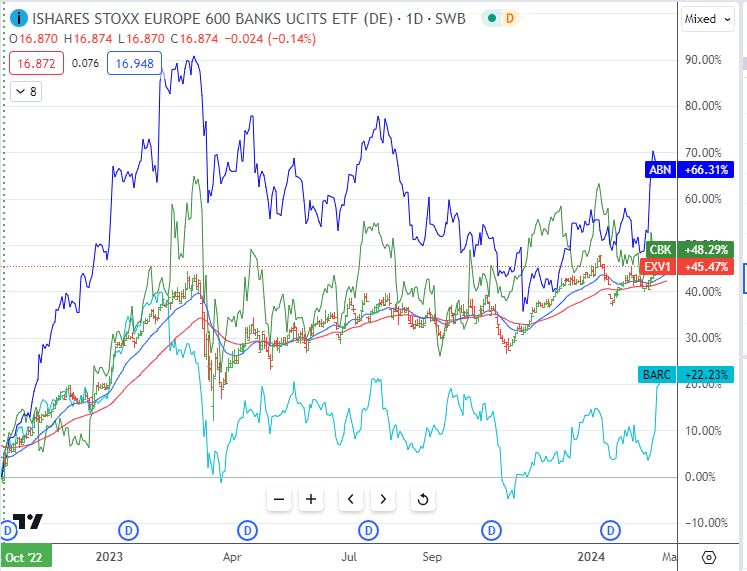

Commerzbank AG (CBK.DE): German Bank. Added to managed portfolio to replace ABN Amro (ABN.AS) assigned last options expiry. Wrote covered call for 0.84% premium with 4.58% price coverage.

Chart confirms the instinct that ABN (dark blue line) had moved ahead of the cohort and Commerzbank (green line) was lagging it. The other bank trade above is lagging even lower (Barclays - light blue line)

Global X Lithium ETF (LIT): Lithium. Averaged down entry price in managed portfolio.

With sales of two Japan stocks (below) ran the stock screens to deploy the proceeds - A quick reminder on the screens. 3 fundamentals, price to book, price to sales and price earnings and 3 technicals, one month high, 20EMA above 50EMA and below 200EMA = looking for weak stocks breaking upwards

Mandom Corporation (4917.T): Japan Consumer Products. Dividend yield 2.99%. Keen to add consumer exposure given the improving state of the economy.

Tess Holdings Co (5074.T): Japan Renewables. Dividend yield 8.73%

One chart to show the shape that I am looking for - price breaks a long running downtrend and makes a confirmed reversal. The lightning indicator at the bottom of the chart indicates news - last earnings were not great but forward guidance is talking about a better 2nd half. Hope they are right - Japanese companies are being hammered by their regulators to improve guidance reporting

Torex Semiconductor (6616.T): Japan Semiconductors. Dividend yield 2.87%

Chart looks much the same - longer running downtrend with a failed attempt midway to break up. Japanese Government announced a big injection into rebuilding the semiconductor industry in the week - hence this addition.

The Furukawa Battery Co (6937.T): Japan Industrials. Dividend yield 2.05%

Marathon Oil Corporation (MRO): US Oil. Added to holding to replace Alerian MLP (AMLP) assigned last options expiry.

Sunpower Corporation (SPWR): Solar Power. Averaged down entry price - solar's time will come back. Wrote covered call for 3.9% premium with 29.6% price coverage.

Sold

Amundi MSCI Japan ESG (JUPI.DE): Japan ESG Index. With Nikkei 225 hitting 34 year high started the process of locking in profits - partial fill for 13.3% profit since July 2023. That profit hides the merger profit when the ETF was created of 84% since 2011. Position was set up when the managed portfolio started as a simple way of investing in Japan.

Mitsui Engineering & Shipbuilding (7003.T): Japan Industrials. Closed out at 52 week high for 49% blended profit since March 2017/December 2019/December 2023. Last tranche added when stock made big movers list twice in a few weeks added 152% profit.

Kato Sangyo Co., Ltd (9869.T): Japan Food Distribution. 44% profit since September 2021.

Barclays Group plc (BARC.L): UK Bank. Assigned early on covered call in personal portfolio - breakeven trade since October 2023. Did make profits from income trades since then. In pension portfolio, 8.2% blended profit since November/December 2023. Income trades added another. Covered call income ramped up that profit by another 59% since November 2023.

Abbott Laboratories (ABT): US Pharmaceuticals. Closed at 52 week high for 3% blended profit since August/December 2021/November 2022/December 2023. Averaging down helped. Simply ran out of patience and not enough shares to write covered calls. Initial trade entry was Jim Cramer idea to leverage Covid19 testing kits - no wonder this has run out of steam. See TIB554

Qualcomm Inc (QCOM): US Semiconductors. Profit taking in pension portfolio to raise capital to cover exercise risk - locks in 37.3% blended profit since August/September 2023.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 30% profit or 20% if 52 week high is lower than 30% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

Scale Ins

Universal Store Holdings Ltd (UNI.AX): Retail. Dividend yield 5.10%

Top Ups

Pilbara Minerals Ltd (PLS.AX): Lithium. Dividend yield 3.10%

Chart shows price bottoming out at previous lows and making the reversal. Entry averages down entry price

APM Human Services International Ltd (APM.AX): Human Resources. Dividend yield 4.90%. APM was top of the big movers list last week and appeared on stock screens a few times. The move came from a buyout bid. Chose last week not to top up ahead of earnings and they rejected the buyout bid. That bid was raised this week above the current price - added a parcel to average down entry price. Broker target revision is around the new average cost = a breakeven exit is possible.

Sold

Costa Group Holdings Ltd (CGC.AX): Food Products. Takeover by private equity locks in 9.1% profit since April/November 2022/June/November 2023.

Ampol Ltd (ALD.AX): Gasoline Marketing. Sold at 52 week high for 22.3% blended profit since February/July/October 2023.

GR Engineering Services Ltd (GNG.AX): Mining Services. Closed at 52 week high for 12.3% blended profit since June/July/September 2023. Must have been some finger trouble as normally set at 20% profit target if price reaches 52 week high - i.e., stretch the sell to get to 20% target. Going to up that to 25% in line with the increase in other sales target to 35%.

Cryptocurrency

Uniswap (UNIBTC): 50% profit target hit in just one week

Holo (HOTETH): 50% profit target hit in just over a month above the level of the last partial exit

Started a Top 10 investing program in February 2023 with a A$10k investment each month - did 6 months worth over the year - 50% in Bitcoin, 25% in Ethereum and 25% in a another top 10 coin based on laggedness. Time for an update.

Bitcoin up 192% from the first entry. Ethereum up 122% (no chart)

And the leader - Solana up 490% - some of that profit was switched to Litecoin.

Income Trades

26 covered calls written across 3 portfolios - am focusing on writing calls at breakeven or better. (UK 1 Europe 3 US 22)

Naked Puts

A few naked puts written for pure income

Engie SA (ENGI.PA): French Utility. Return 0.97% Coverage 3%

Coeur Mining (CDE): Silver Mining. Return 3.2% Coverage 6.8% - price drop on the day tightens coverage quite a bit.

Wynn Resorts (WYNN): Gaming. Return 0.33% Coverage 10%

A few naked puts written on stocks that could be on covered calls - change of approach. Rather than writing at likely assigned price, writing one strike below.

Coty Inc. (COTY): US Consumer Products. Return 0.72% Coverage 5.6%

ING Group (INGA.AS): Dutch Bank. Return 0.72% Coverage 1.3%

Rolled out a few sold puts to reduce exercise risk in March expiries - some made profits on the buy backs

Société Générale SA (GLE.PA): French Bank 8.5% profit 6.6% cash positive

Fiverr International Ltd. (FVRR): Internet Services. 51.2% loss 1.7% cash positive. Did manage to do the trade twice - landing up with a March/April reverse calendar put spread. Fixed that next day - a little less cash positive than before.

Invesco Solar ETF (TAN): Solar Power. 9.4% loss 5.6%

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. 2.7% profit 9.8%

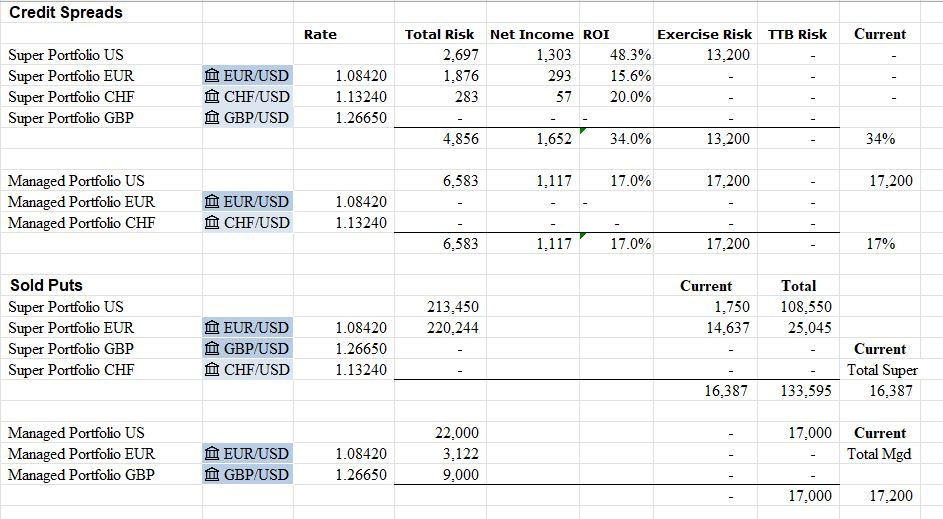

Credit Spreads

After the last two weeks seeing portfolios lagging while US markets steamed ahead on tech stocks - added a few credit spreads to start working back into positions.

Advanced Micro Devices (AMD): US Semiconductors. ROI 14.4% Coverage 10%

Lockheed Martin Corporation (LMT): Aerospace/Defense. ROI 42% Coverage 1%

NVIDIA Corporation (NVDA): US Semiconductors. ROI 11.7% Coverage 11.4%

Exercise risk for the current options expiry reduced considerably - risk still sits there but now into April. Total risk in pension portfolio is now inside cash margin after the profit taking sales made above.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

February 25 - March 3, 2023