Commodities are moving. No surprise to find the week was spent mostly on uranium and gold mining and base metals

Portfolio News

In a week where S&P 500 dropped 0.89% and Europe dropped 0.86%, my pension portfolio dropped a more modest 0.5%. Drags were a few ASX resource stocks (Kairos - KAI.AX down 14.3%), UK stocks, Japan, and in US (Fiverr (FVRR), Marriott Vacations (VAC), and US Treasuries (TLT)). Doing the lifting were Canadian stocks (cannabis, gold/silver mining and uranium).

Managed portfolio went up 1.5% with a heavier weighting to Canada (cannabis, silver/gold mining, uranium), a few big jumps in Europe and a big holding in Cameco (CCJ).

Big movers of the week were Lifeist Wellness (LFST.V) (100%), CoreNickelCo (CNCO.CN) (66.7%), Aurora Cannabis (ACB.TO) (52.1%), 88 Energy (88E.AX) (40%), Stroud Resources (SDR.V) (40%), Coeur Mining (CDE) (29.2%), Elixir Energy (EXR.AX) (26.8%), GoviEx Uranium (GXU.V) (26.1%), Honey Badger Silver (TUF.V) (23.1%), GoGold Resources (GGD.TO) (21.1%), Dawson Geophysical (DWSN) (21.1%), Canopy Growth (WEED.TO) (18.9%), Standard Uranium (STND.V) (18.2%), St Barbara Limited (SBM.AX) (17.1%), Delivra Health Brands (DHB.V) (16.7%), Pan American Silver (PAAS) (16.2%), Solis Minerals (SLM.AX) (16.2%), Baytex Energy (BTE)(15.5%), NuScale Power Corporation (SMR) (14.9%), Hecla Mining (HL) (14.9%), IsoEnergy (ISO.V) (14.6%), Cameco Corporation (CCJ) (13.6%), Aeris Resources (AIS.AX) (12.9%), LANXESS (LXS.DE) (12.4%), Cue Energy Resources (CUE.AX) (11.9%), Sigma Lithium (SGML) (11.5%), Global Atomic Corporation (GLO.TO) (11%)

26 stocks in the big movers in a down week is a bumper list. The big themes from the last few weeks keep running - cannabis (4 stocks), uranium (5 stocks plus one nuclear power), silver/gold mining (8 stocks), lithium (2). 3 oil stocks in the list with two based on drill results - 1 in Alaska, 1 in Australia

Markets started the new quarter weakly - with several down days. Some signs of life on Monday with only Dow Jones down. The jobs report on Thursday changed the mood - a stronger than expected jobs number coupled with a less than expected rise in wage demands made the mood better.

This headline from my Australia research house reinforeced what I wrote last week

Soft, Softer or Softest?

It feels like a softest scenario playing out. The coming week is a bit short of data to drive direction - and then it is earnings season again.

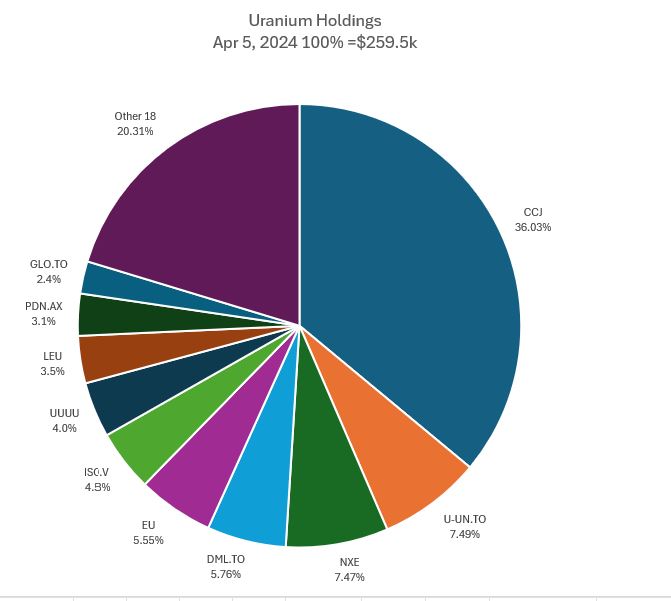

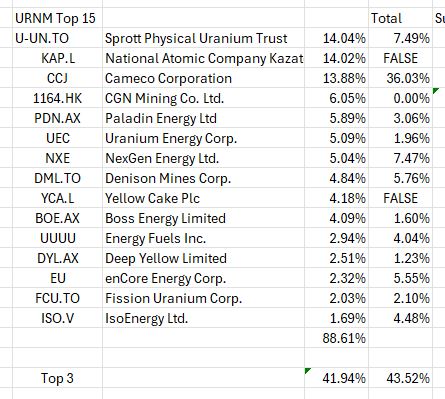

Uranium Holdings

Uranium holdings went up to 13.5% of total portfolio value - a bit higher than target - total value us up based on higher prices and a few portfolio additions.

A few changes in the mix with Dennison (DML.TO) and Encore Energy (EU) changing places and Energy Fuels (UUUU) going up a place. Additions to the ASX holdings in pension portfolio hardly changed the relative rankings.

The key element is the large holding in Cameco (CCJ) now 36% of total holdings. Two factors to bear in mind - holdings will be reduced at the next options expiry if price stays above the $49.21 close (Apr 5) at expiry - covered calls are set at strike below that. 2nd is the Top 3 holdings in Sprott Uranium Miners ETF (URNM) account for 41.9% and across my portfolios, the top 3 are a little higher at 43.5%.

The plan at the next options expiry if those Cameco holdings are assigned will be to run credit spreads on Cameco and distribute the holdings across the Uranium Insider core focus list.

Market news in the week - South Korea announces plan to extend life of 3 units in Wolseong plant.

Crypto Drifts

Bitcoin price drifted lower all week ending 3% down wth a peakt to trogh range of 9.6% - pretty normal for a week the stock markets go down.

Ethereum price did much the same but did manage a recovery from midweek ending 3% down with a peak to trough range of 11.5%

All the altcoins in my portfolios had similar charts - drifting lower and then recovering a little but ending the week down.

Bought

Energy Fuels Inc (UUUU): Uranium. Energy Fuels is not one of my target stocks. Have a holding in my pension portfolio which is a little under water. Decided to average down entry price on an up day for uranium stocks with a veiw to exiting at breakeven. Not convinced the management team is focused enough on the uranium vs rare earths opportunity to make a winner in uranium.

Chart shows the four entry points (the blue rays). Also note a lesson about asking to be filled at mid-price before the market opens - got filled badly in January. This trade was done as a limit order. Breakeven is now $7.34 - will write covered calls at strike just above this and use that as exit strategy.

VanEck Vectors Gold Miners ETF *GDX): Gold Mining. While doing the silver mining analysis for last week, observed something of a similar move upwards in gold miners. Started to buy in a bit more through the gold miners ETF in the pension portfolio.

Chart shows 17 percentage points difference between gold and silver miners (SIL - blue line) and 5 percentage points ahead of silver (the bars). Some of the difference comes from the way the gold miners moved on the first day of the quarter.

iShares MSCI Emerging Markets ex China ETF (EMXC): Emerging Markets. With the profitable expiry of an April call spread risk reversal, was keen to put on another trade. Was hit on the sold put portion of the trade (55) and waiting for the bought call spread to execute.

Euro Manganese Inc (EMN.AX): Base Metals. Averaged down entry price in personal portfolio on the back of permitting news.

Genmin Limited (GEN.AX): Base Metals. Newsletter from Next Investors highlighting their new investment in "green steel.

Genmin are permitted to operate a high grade iron ore mine in Gabon, West Africa with agreed offtakes in place and access to hydroelectric power. Green comes from the high grade and hydro used to do the mining. Am always wary of investments in Africa - lived there long enough to see things go wrong. Made this an options type trade - small nibble.

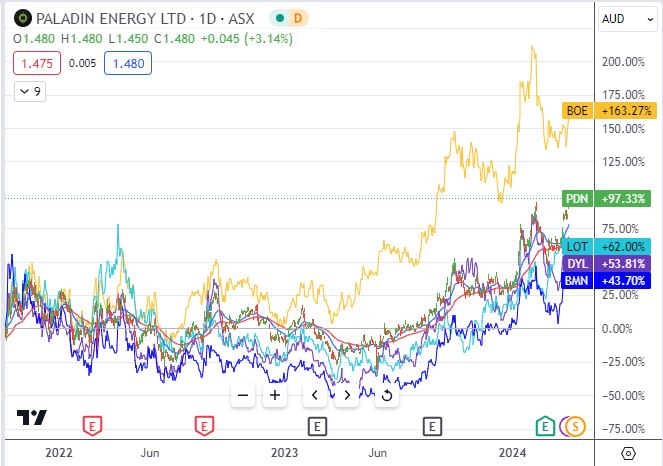

Added ASX listed uranium stocks to pension portfolio to increase weighting of uranium. Paladin announced that they are close to recommencing production at their Langer Heinrich mine in Namibia.

Bannerman Resources (BMN.AX): Uranium. Deep Yellow Ltd (DYL.AX): Uranium. Paladin Resources (PDN.AX): Uranium.

Plotted the major ASX listed stocks against Paladin (the bars) and picked three lowest - already have a sizeable holding in Lotus Resources (did not add any more to that) All 3 have mines in different stages of development in Namibia.

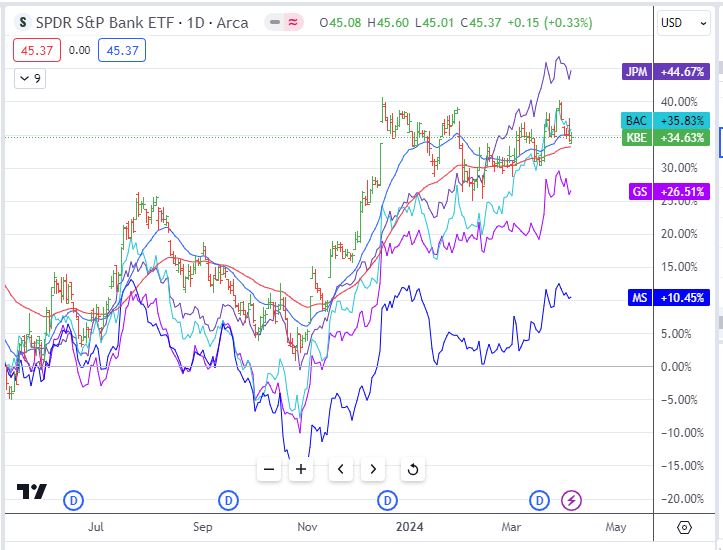

Bank of America Corporation (BAC): US Bank. TheStreetPro team added to their bank holdings - chose to add back a holding in the pension portfolio. In managed and personal portfolios set up an April expiry 36/34 credit spread offering 18.3% ROI with 2.6% price coverage.

Morgan Stanley (MS): US Bank. merger activity is increasing in US.

Looked at comparative charts for the major investment banks - picked Morgan Stanley as they are lagging the other two major players. Wrote covered call for 0.69% premium with 6.3% price coverage.

enCore Energy Corp (EU): : Uranium. Replaced Canadian listed holding sold below for the US listing - can write options on the US listing.

Sold

enCore Energy Corp (EU.V) : Uranium. Closed out Canadian listing holding in pension portfolio - will replace with the US listing as it has options market. Locks in 24% profit since December 2023.

Global X MSCI Nigeria ETF (NGE): Nigeria Index. Liquidated by Global X - 82.9% loss. So much for rising oil revenues to profit the nation.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 30% profit or 20% if 52 week high is lower than 30% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

APA Group (APA.AX): Gas Utility. Dividend yield 6.60%

Chart shows price has had a few goes at recovering after breaking the downtrend - maybe this time. Gas distribution remains a solid business - a move back to the level where price dropped steeply is well over the 35% profit target

Scale Ins

With move ahead in gold prices scaled into 3 out of the 4 gold miners to average down entry prices

Silver Lake Resources Ltd (SLR.AX): Gold Mining.

Regis Resources Ltd (RRL.AX): Gold Mining. Dividend yield 1.13%

Aeris Resources Ltd (AIS.AX): Copper/Gold Mining.

Auto Invest

Vanguard MSCI Index International Shares ETF (VGS.AX): International Index. Dividend yield 1.6%

Vanguard Australian Shares Index ETF (VAS.AX): Australian Index. Dividend yield 6.5%

Income Trades

Covered Calls

6 new covered calls written all in pension portfolio in US with one for May expiry, the rest April 19.

Tilray Brands (TLRY): Marijuana. The run up in cannabis stocks has caught a few covered call positions in-the-money. Decided to roll out and up half the covered calls - incurs a 500% loss on the buy back and was not cash positive on the roll out (10% down). Time to be more patient on cannabis holdings - the time will come. Did see a Wall Street Journal article on April 6 discussing Ohio and Pennsylvania legalisation moves likely to play out for 2025 - hold time.

Read it here - free

Naked Puts

Marriott Vacations Worldwide Corporation (VAC): Hotels. Return 0.7% Coverage 7.5%. Added sold put as covered call could go to assignement at a higher strike.

Elevance Health (ELV): US Healtchare. TheStreetpro averaged dwon their holding. Added another sold put in managed portfolio this time. Return 0.43% Coverage xx%

Jazz Pharmaceuticals (JAZZ): US Pharmaceuticals. Found a new investment advice area on TheStreetPro site - options trades. They have this as a sold put idea, Return 1.52% Coverage 2.2%

Invesco Solar ETF (TAN): Solar Power. With price opening at $43.14 (Apr 5), kicked the can down the road on a 50 strike naked put. Buy back at 12% profit and 6.9% cash positive. Could not get a lower strike and stay cash positive. Getting this holding back to profit will take some time - might be best to go to assignement and then just hold the stock.

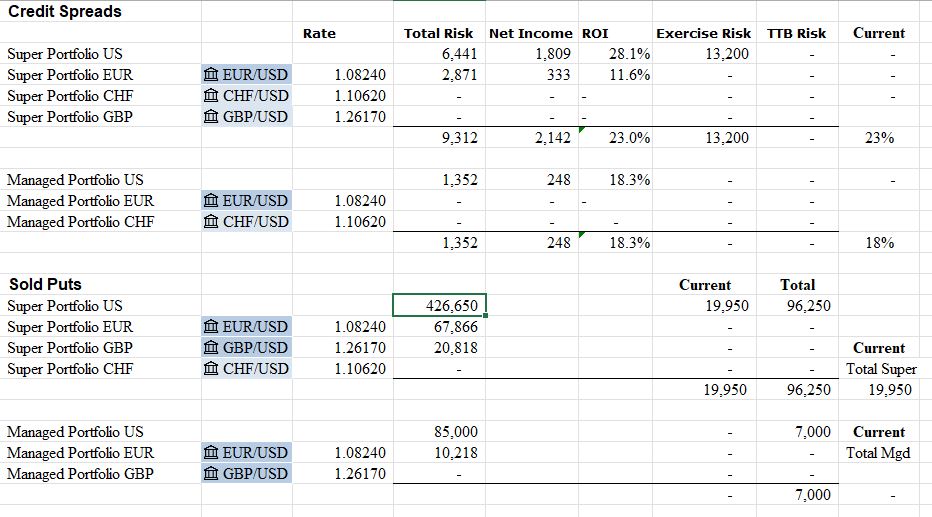

Credit Spreads

NuScale Power Corporation (SMR): Nuclear Power. With price opening at $6.38 closed out the bought leg of a 7/4 diagonal credit spread. Have a leve of confidence that price will settle closer to $7 than to $4. Now open as a May expiry strike 7 naked put

Current exercise risk in all portfolios is within cash margin limits. However some risk in the pension portfolio in months ahead. Coming options expiry is key with a few large ticker holdings - AMD, ELV, VAC, XLK - all look safe for now.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

April 1-5, 2024